Subscribe to

Posts [Atom]

Thursday, April 16, 2009

Dick Burr, Banking Genius

"Tonight, I want you to go to the ATM machine, and I want you to draw out everything it will let you take. And I want you to tomorrow, and I want you to go Sunday," Senator Dick Burr told his wife Brooke following a briefing on the looming banking crisis by the Bush Treasury Secretary Hank Paulson last year. "I was convinced on Friday night that if you put a plastic card in an ATM machine the last thing you were going to get was cash."

"Tonight, I want you to go to the ATM machine, and I want you to draw out everything it will let you take. And I want you to tomorrow, and I want you to go Sunday," Senator Dick Burr told his wife Brooke following a briefing on the looming banking crisis by the Bush Treasury Secretary Hank Paulson last year. "I was convinced on Friday night that if you put a plastic card in an ATM machine the last thing you were going to get was cash."After the senator's rather revealing confession made a national ripple yesterday, Burr's spokesman tried to damp down the amazement: "The senator is simply trying to express what was on his mind as Congress was attempting to respond to the financial crisis last fall."

What was clearly on his mind was grabbing all the cash he could before the rest of the country found out what he'd been told as a privileged individual who gets briefings from the Treasury Secretary.

A panicky senator with little to no understanding of the U.S. banking system, combined with the "me first" attitude of your run-of-the-mill survivalist ... that's our North Carolina boy!

Labels: bank failures, Bush economy, Richard Burr

Friday, November 21, 2008

Madam Foxx Has a Hissy

Former professional Bush-smoocher and giant Puritan Virginia Foxx has decided that El Presidente is an idiot and his Treasury Secretary Hank Paulson is a dried up old piece of dog feces, who has done everything wrong in the Bush/Paulson bank bailout, so Foxx has introduced legislation which would mandate stuffing the remaining $350 billion, one dollar bill at a time, up Hank Paulson's alimentary canal, then making him excrete it WITH INTEREST, even after he leaves office on January 20th. The bill also calls for putting a GIS locator on Paulson, so that he can be found anywhere in the universe AFTER January 20th and be beaten with broomsticks. And what was this Bush Administration THINKING, anyway?

Former professional Bush-smoocher and giant Puritan Virginia Foxx has decided that El Presidente is an idiot and his Treasury Secretary Hank Paulson is a dried up old piece of dog feces, who has done everything wrong in the Bush/Paulson bank bailout, so Foxx has introduced legislation which would mandate stuffing the remaining $350 billion, one dollar bill at a time, up Hank Paulson's alimentary canal, then making him excrete it WITH INTEREST, even after he leaves office on January 20th. The bill also calls for putting a GIS locator on Paulson, so that he can be found anywhere in the universe AFTER January 20th and be beaten with broomsticks. And what was this Bush Administration THINKING, anyway?Labels: bank failures, Virginia Foxx

Friday, October 10, 2008

Generous

Even as Wachovia, the fourth-largest bank in the country, was announcing some $9 billion in losses and was cutting over 11,000 jobs and turning down most loan requests, it was also lending the National Republican Congressional Committee (NRCC) $8 million to try to save GOP gonads in the upcoming elections. Facing South has the details.

Even as Wachovia, the fourth-largest bank in the country, was announcing some $9 billion in losses and was cutting over 11,000 jobs and turning down most loan requests, it was also lending the National Republican Congressional Committee (NRCC) $8 million to try to save GOP gonads in the upcoming elections. Facing South has the details.The timing of this Wachovia loan to the NRCC raises obvious questions. At the same time that Wachovia had cut off loans to some 1,000 colleges and while it was in the middle of "precarious and bitterly-contested buyout negotiations" involving federal guarantees to cover billions of $$ in losses ... it doles out money for partisan political activity.

This is an especially troubling loan because the NRCC has been wracked with scandal. It borrowed $9 million from Wachovia in 2006. It has been revealed that the NRCC's Treasurer, Christopher Ward, embezzled as much as $725,000 from the org. "Among other misdeeds, to cover up his tracks Ward and the NRCC submitted forged audit reports to Wachovia in 2006 to obtain their loan." Before the Ward embezzlement came to light, the NRCC had failed to conduct an independent audit of its activities since 2003.

And so it goes.

Labels: bank failures, National Republican Congressional Committee, Wachovia Corporation

Monday, September 29, 2008

Crap Sandwich

That's the term House Minority Leader John Boehner used to describe the financial rescue package, but he could have been speaking of any number of meals served up in the waning days of the failed Bush presidency.

That's the term House Minority Leader John Boehner used to describe the financial rescue package, but he could have been speaking of any number of meals served up in the waning days of the failed Bush presidency.Just this a.m. are headlines that would have attracted major fainting spells in any normal universe but which, under the present circumstances, get only yawns:

Citigroup Eats Wachovia Whole; Charlotte Can't Find Its Pulse

US Congress Passes $25 Billion Loan Guarantees to Fossils in Auto Industry

While her congressional leadership all prepare to munch on Bush's failure, Madam Foxx has been signaling furiously that she'll vote against the financial industry bailout. We think we'd join her in that. We think. Hard to know, since the wrong vote could actually be crucial in sending the whole she-bang into some bottomless tank.

Labels: bank failures, Bush economy, financial crisis, Virginia Foxx

Thursday, September 25, 2008

It Wasn't a Frickin' Stream!

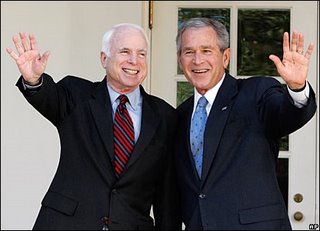

As John McCain was using the financial crisis as a means to save his mortgaged candidacy, and decided to air-drop himself into the negotiations, El Presidente graciously invited both candidates and a host of Congressional leaders in this afternoon to share in the disgrace of his presidency.

As John McCain was using the financial crisis as a means to save his mortgaged candidacy, and decided to air-drop himself into the negotiations, El Presidente graciously invited both candidates and a host of Congressional leaders in this afternoon to share in the disgrace of his presidency.For those many voters who told us in 2004 that, although they thought George W. was a bald-faced liar and multitudinously inept, they were afraid "to change horses in the middle of the stream," we wonder how they're feeling now that El Presidente has ridden us into the deep blue sea.

Thrown us into the drink and then announced that we'd have to pay MUCH more for a life preserver and that we needed to pay for it RIGHT NOW.

Treasury Secretary Henry Paulson's original demands of Congress are posted in their entirety here, for your amazement and edification. Be sure to get a load especially of the notorious Section 8, titled "Review," which runs one whole sentence, to wit:

Decisions by the Secretary pursuant to the authority of this Act are non-reviewable and committed to agency discretion, and may not be reviewed by any court of law or any administrative agency.

That's the Bush administration in a nutshell.

NUT. SHELL.

Sen. Chris Dodd's counter legislation is also posted here, but we understand that it's been tinkered with further in consultation with U.S. House leaders, so this isn't the final version being discussed this afternoon at the Booby-Hatch (a.k.a., White House).

John McCain's grandstanding about all of this is just this side of pathetic. We're supposed to get BACK on this particular horse/elephant? Gee thanks, but this time I think I'll walk.

Labels: bank failures, Bush administration, Chris Dodd, George W. Bush, John McCain

Wednesday, September 24, 2008

The Hot (Warm?) Breath of the Law

We learn this a.m. that the F.B.I. is investigating the American International Group (AIG), Freddie Mac, Fannie Mae, Lehman Bros., IndyMac Bancorp Inc., and Countrywide Financial Corp. for accounting fraud, insider trading, and failure to disclose the value of mortgage-related securities and other investments. In fact, F.B.I. Director Robert Mueller admits that he's got 24 large financial firms under investigation.

'Bout time.

But this news does raise another, related issue. The Bush administration wants Congress to donate up to $1 trillion to this bunch of thieves for their worthless paper "securities"? Boggles the mind.

Labels: bank failures, Bush administration, Bush economy

Tuesday, September 23, 2008

The Consequences of Memory

"There really was a wolf here! The flock has scattered! I cried out, 'Wolf!' Why didn't you come?"

An old man tried to comfort the boy as they walked back to the village.

"We'll help you look for the lost sheep in the morning," he said, putting his arm around the youth. "Nobody believes a liar ... even when he is telling the truth!"

--"The Boy Who Cried Wolf"

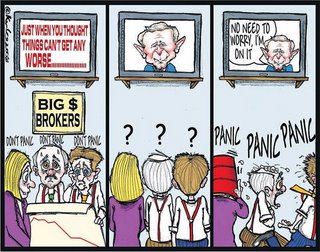

Reading congressional reaction to the Bush administration's attempt to scare our reps. into agreeing to El Presidente's latest attempt at a massive power grab (a.k.a., the Paulson plan to spend $800 billion hauling Wall Street's nuts out of the brazier), we are strongly reminded of the cautionary tale from kindergarten days, the ending of which is copied above as a life lesson. Our Little Boy in the White House has cried "wolf!" several times too many.

Virginia Foxx (who should know a wolf when she sees one) objected strenuously to the $85 billion bailout of AIG last week, but Foxx says now she's not sure how she'll vote on the $700 billion. If she reads her own quote in the press, surely she'll vote against it: "looks like a blank check with no accountability. Taxpayers deserve better." You betcha, Congresswoman. (Must be a blue moon tonight, since I'm agreeing with The Madam.)

Other N.C. members of both House and Senate are expressing something steelier than mere skepticism. Let's hope their resistance spreads like a virus through Congress:

"I'm not willing to vote for $700 billion to save an industry that comes out just as crooked on the other end. I want real reforms." --Rep. Brad Miller (NC-13)

"Lots of people were asking 'Will there be something in this package for people who are trying to pay off their mortgages but having trouble, and not just people on Wall Street?' " --Rep. Mel Watt (NC-12)

"I just don't like the idea of these corporations, who made all these mistakes, all of a sudden saying, 'OK, Mr. Taxpayer, it's time for you to bail us out. [The Bush administration has] tried to panic the American people." --Walter Jones (NC-3)

"I don't think those advocating for the rescue have fully made their case. I have very serious concerns that this proposal could leave taxpayers holding the bag." --Sen. Elizabeth Dole

"Ultimately, my responsibility is to the American taxpayer, who will be the underwriter of this dramatic proposal." --Rep. Patrick McHenry (NC-10)

Okay, we're reading that the Bushies are compromising on some things, but greater over-sight and accountability...? Dunno. Who does?

Thing is, we can recognize an attempted stampede when we see one, a stampede caused by Grade-A known liars.

Labels: bank failures, Bush administration, Elizabeth Dole, Patrick McHenry, Virginia Foxx

Sunday, September 21, 2008

1.4 Trillion

That's the projected cost to taxpayers, adding up what we've already spent on Fannie Mae, Freddie Mac, AIG, and the new $700 billion Congress is being stampeded into passing before anyone thinks too hard and long about what we're doing.

That's the projected cost to taxpayers, adding up what we've already spent on Fannie Mae, Freddie Mac, AIG, and the new $700 billion Congress is being stampeded into passing before anyone thinks too hard and long about what we're doing.So how do you like Republican Socialism? It's different from other socialisms. It's Trickle-Down. Bailouts for the already rich mis-managers of financial institutions with apparently no strings attached. Even foreign banks get some love but not the individual homeowner with an adjustable rate mortgage.

All of this has made John McCain hop faster and higher than a frog on a griddle. If the man ever did have a set of core principles, they're dust today. Treasury Secretary Henry Paulson has seen to that. McCain was Mr. Deregulator on Monday. He's not that today, or at least not in public.

But back to that $700 billion (maybe more) they're asking us to give to the Bush administration, which couldn't manage the aftermath of a hurricane (make that two hurricanes, if you've checked in on Texas lately) and which invaded a country we didn't need to invade on false pretenses. They don't want Congress asking too many questions about this bailout. They don't want us citizens to worry.

What, me worry?

Labels: bank failures, Bush economy, Henry Paulson, John McCain

Monday, September 15, 2008

Fallout

The Big Lesson of the Bush years: the bigger you are, the faster you circle the drain.

The Big Lesson of the Bush years: the bigger you are, the faster you circle the drain.John "I know a lot less about economics" McCain has a plan for plugging the drain? How about Sarah "In what respect, Charlie?" Palin?

But, then, neither does Obama. Nobody has a plan (though we suspect a whole bunch of guys and gals with eye shades are getting headaches over it about now).

The question that we would direct in John McCain's general direction: Why would we want the economics philosophy that has dug this gapping hole back in charge of everything for another four years?

Labels: bank failures, Barack Obama, John McCain, Sarah Palin

Saturday, September 06, 2008

Another Unwelcome Ripple

We're beginning to figger out the Republican philosophy for handling the U.S. economy: privatize profits while socializing losses. As in ... Fannie Mae and Freddie Mac. Seems ever more likely that we taxpayers will be saddled with the losses from bad management, while the CEOs and their fellow suits make off with the profits.

We're beginning to figger out the Republican philosophy for handling the U.S. economy: privatize profits while socializing losses. As in ... Fannie Mae and Freddie Mac. Seems ever more likely that we taxpayers will be saddled with the losses from bad management, while the CEOs and their fellow suits make off with the profits.But immediately after reading about Fannie and Freddie and little Hankie Paulson, the Bush administration treasury secretary, and their mutual benefit tea party, we also noticed this warning note about the Dell manufacturing plant in Winston-Salem.

The Wall Street Journal is saying that Dell may sell the plant just three years after the corporation received more than $6.5 million in city incentives and nearly $1.2 million in county incentives. There's something called a "claw-back clause" in the incentive deal that would force the company (supposedly) to pay back up-front incentives if it sells or closes the plant before Oct. 2010. If it closes or sells the plant between 2010 and 2015, it's liable for only half the incentives.

That's if Dell decides to honor the contract. A company that needs to downsize as badly as the W-S Journal suggests it does might find ways to get outta town scot free. Isn't that why they have lawyers?

What's up with Dell's cash-flow?

The plant and the employees ... are on the wrong side of an industrywide trend toward slowing desktop sales and surging notebook sales as the price of notebooks continues to fall. Dell has said repeatedly that it has no plans to assemble notebooks at the Forsyth plant, citing much lower production costs overseas.

Labels: bank failures, Bush economy, Dell Corporation

Tuesday, July 22, 2008

Whoa, Nellie

"Wachovia Corp. announced a whopping second quarter loss of $8.9 billion this morning"

"Wachovia announced this morning that it plans to cease making mortgages through third-party brokers"

"The change in strategy is part of a larger plan to rein in mortgage losses, which have been on the rise since Wachovia's $24 billion purchase of Golden West Financial Corp., a troubled California mortgage lender, in 2006"

Said Lanty Smith, the Wachovia board chairman, "...we at Wachovia accept responsibility"

We also accept our inflated salaries and whopping bonuses, he might have added.

Labels: bank failures, Wachovia Corporation

Thursday, July 17, 2008

The Corruption of Big Money

--The Political Junkies, commenting on the Bush plan to bail out Fannie & Freddie

And this: "To rescue Fannie and Freddie is the ultimate implementation of socialism for the rich and the well connected."

Then this: "As with the bailout of Bear Stearns Co., corporate interests and stockholders get the benefit of taxpayer dollars propping up insolvent companies or limiting their stock losses. For the average American who is facing a home foreclosure, Republicans merely call them 'irresponsible,' and leave them to lose their homes."

Labels: bank failures, George W. Bush

Tuesday, July 15, 2008

Mighty Close to Home

Monday, July 14, 2008

Weather Continues Fine, With Good Visibility

Apparently, if you've got enough political mojo, you can find an economist to predict whatever you want predicted, which perhaps accounts for all that continuing willful belief out there that the economy is actually just hunky-dory, and if we say or (heaven forbid!) THINK differently, we're WHINERS or off our friggin rockers, so we're not supposing here that the economic analysts cited below are any more infallible than the Bush Team of Certified Geniuses, but still. Some smart people think we're in deep doo-doo and that Republican economic policies are largely to blame, starting with their deregulation of the mortgage industry.

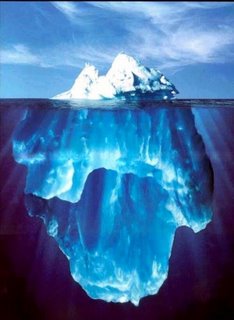

Apparently, if you've got enough political mojo, you can find an economist to predict whatever you want predicted, which perhaps accounts for all that continuing willful belief out there that the economy is actually just hunky-dory, and if we say or (heaven forbid!) THINK differently, we're WHINERS or off our friggin rockers, so we're not supposing here that the economic analysts cited below are any more infallible than the Bush Team of Certified Geniuses, but still. Some smart people think we're in deep doo-doo and that Republican economic policies are largely to blame, starting with their deregulation of the mortgage industry.John Mauldin, for example. He seems to have predicted the housing bubble back in 2005, and now he's predicting the largest credit contraction in DECADES (he uses all caps too), based on projections that there are another $1.6 TRILLION in bank losses (world-wide) yet to come, "four times official estimates and enough to pose a grave risk to the financial system."

In other words, IndyMac in California and Fannie Mae and Freddie Mac are the tip of a very large iceberg.

Large and unpredictable enough to cause Treasury Secretary Paulson to say last Thursday that "no bank is too big to fail. That is for public consumption." Large and unpredictable enough even to cause John McCain to change his tune, abandoning Republican boilerplate gospel (no government intervention), which he was still spouting in May, to his blind staggers of last Thursday following Secretary Paulson's dire warning: "Give us government bailouts. Please!"

"And, by the way, please put me and my slavish adherence to Bushonomics in charge of your economic futures. I promise to be as sunnily clueness as our last schmo."

Labels: bank failures, Bush economy, John McCain, mortgage crisis

Saturday, July 12, 2008

Anyone Up for Dominoes?

If this news doesn't make your throat go a little dry, you've maybe drunk more of the George-Bush-Virginia-Foxx economic Kool-Aid than is necessarily good for you.

If this news doesn't make your throat go a little dry, you've maybe drunk more of the George-Bush-Virginia-Foxx economic Kool-Aid than is necessarily good for you. "The federal government took control of Pasadena-based IndyMac Bank on Friday in what regulators called the second-largest bank failure in U.S. history."

Yep, "defaulted mortgages" cited as the prime cause.

T-Men also are standing by this weekend to take over Fannie Mae and Freddie Mac, which together hold almost half of the nation's mortgage debt.

IndyMac is the fifth FDIC-insured failure of the year. No one expects it to be the last.

Sen. Chuck Schumer (D-N.Y.) blamed (in part) Bush administration regulators for allowing IndyMac to run out of control; Bushies and IndyMac executives blamed Schumer for prompting a run on the bank. It's always nice to have someone else to blame.

Labels: bank failures, Bush economy, Charles Schumer, Virginia Foxx