Subscribe to

Posts [Atom]

Thursday, March 05, 2009

Jon Stewart Strafes CNBC

Man, oh man. Did you see Jon Stewart last night on The Daily Show rip into those nimrods over at CNBC? Starting with Rick Santelli, but hardly stopping there. In fact, Stewart's whole show might be dubbed "Wall Street (and Those Who Enable It) Are Dicks," and it's worth watching all three segments, including his interview with Joe Nocera, business columnist for the NYTimes. The videos are all here, labeled "CNBC Gives Financial Advice," "The DOW Knows All," and "Joe Nocera."

Best line: "If I'd only followed CNBC's advice, I'd have a million dollars today, provided I started with a hundred million dollars."

Best line: "If I'd only followed CNBC's advice, I'd have a million dollars today, provided I started with a hundred million dollars."

Labels: CNBC, financial crisis, Jon Stewart, mortgage crisis

Thursday, February 19, 2009

Billmon Explains It All

In a piece titled "Chocolate Covered Cotton," Billmon, of the late lamented Whiskey Bar blog, takes a deep breath and with electrifying clarity and razor wit explains the history of the financial bubble that is still bursting all over the American economy -- and the world's house of cards. As a former financial services journalist and a regular at the Davos World Economic Forums, Billmon has more reserves of knowledge and insight than your average Fox News bimbo (and more than your average MSNBC gasbag, as well).

Might want to pour yourself a stiff drink before you start reading.

Might want to pour yourself a stiff drink before you start reading.

Labels: Billmon, financial crisis

Wednesday, December 03, 2008

Madam Foxx Sees Red

Congresswoman Virginia Foxx has issued a statement. It's a dense congregation of nouns and verbs harassed by numerous adjectives and adverbs, but someone had to read it:

Congresswoman Virginia Foxx has issued a statement. It's a dense congregation of nouns and verbs harassed by numerous adjectives and adverbs, but someone had to read it:What She Said

Amidst the credit crunch and housing crisis too many Washington policy-makers have decided that the federal government must not only bail out teetering banks, but also credit card companies, automakers, life insurance companies and any other company that looks like it might benefit from a billion-dollar infusion of government cash.

What She Meant

This dip-shit running the government – what's his name? I met him once, I think, but didn't really catch his name – why, my housekeeper could do a better job of managing the economy than him, and she doesn’t even read English.

What She Said

As the Washington Post reported, the Bush administration is almost finished doling out the first $350 billion in bailout money.

What She Meant

That's his name! Bush. What a dork. I mean. Couldn't find his ass with both hands and a head start! Whoever put him in charge needs prescription drugs. Muy pronto.

What She Said

The whole bailout concept is now completely different from the bailout that was sold to America back in September (a concept I didn't buy in the first place).

What She Meant

It's tiresome (I know) being so eerily correct about absolutely everything all the time, but it's my cross to bear. Well, actually your cross.

What She Said

Congress can stop the madness.

What She Meant

Obama can suck his chocolate thumb!

Labels: financial crisis, Virginia Foxx

Monday, September 29, 2008

Out of the Loop and Irrelevant

Just hours before members of his own party sent the financial bailout legislation down in flames, Sen. John McCain was in Columbus, Ohio, taking credit for making the deal happen. It's like, uh, nobody among the Republican House leadership bothered to tell their standard-bearer that the measure was going to fail ... as they surely had to know as early as last night.

Makes it clear that McCain's rushing to Washington last week was all part of a staged event so that he could take credit for the legislation. But ... oops. His own party let him down. Only 65 Republican members of the House voted for it. Some 95 Democrats voted against it.

They'll either write a better, fairer bill, or they'll watch the smoke rise over Wall Street a day or two and come back. At least half of my brain is glad they voted it down. The other half is rigid with terror.

Makes it clear that McCain's rushing to Washington last week was all part of a staged event so that he could take credit for the legislation. But ... oops. His own party let him down. Only 65 Republican members of the House voted for it. Some 95 Democrats voted against it.

They'll either write a better, fairer bill, or they'll watch the smoke rise over Wall Street a day or two and come back. At least half of my brain is glad they voted it down. The other half is rigid with terror.

Labels: financial crisis, John McCain

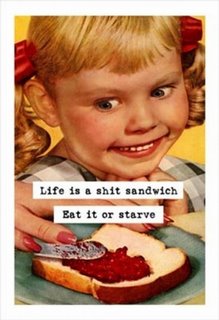

Crap Sandwich

That's the term House Minority Leader John Boehner used to describe the financial rescue package, but he could have been speaking of any number of meals served up in the waning days of the failed Bush presidency.

That's the term House Minority Leader John Boehner used to describe the financial rescue package, but he could have been speaking of any number of meals served up in the waning days of the failed Bush presidency.Just this a.m. are headlines that would have attracted major fainting spells in any normal universe but which, under the present circumstances, get only yawns:

Citigroup Eats Wachovia Whole; Charlotte Can't Find Its Pulse

US Congress Passes $25 Billion Loan Guarantees to Fossils in Auto Industry

While her congressional leadership all prepare to munch on Bush's failure, Madam Foxx has been signaling furiously that she'll vote against the financial industry bailout. We think we'd join her in that. We think. Hard to know, since the wrong vote could actually be crucial in sending the whole she-bang into some bottomless tank.

Labels: bank failures, Bush economy, financial crisis, Virginia Foxx